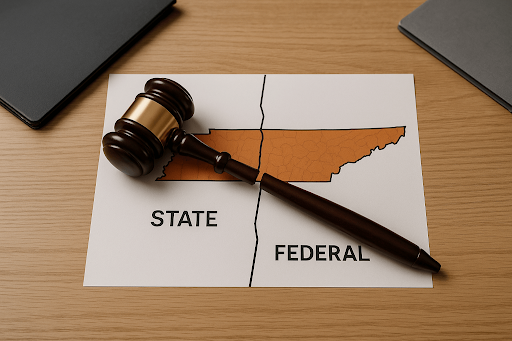

Auto accident litigation often turns on one deceptively simple question: who pays, and under what system of law? That question sits at the center of every personal injury claim involving motor vehicles. The answer depends on whether a jurisdiction follows a traditional fault-based system or a statutory no‑fault regime, two frameworks that define liability, benefits, and access to the courts.

Across the United States, these systems diverge sharply in how they determine responsibility, distribute benefits, and manage disputes. Understanding which system governs a case clarifies how compensation is pursued, what evidence burdens apply, and when litigation can proceed.

This article provides a comprehensive overview of both systems for legal professionals. It maps current auto insurance regimes, outlines key operational differences, and highlights major legislative and judicial developments.

What Are The Legal Foundations of Fault and No-Fault Regimes?

At their core, fault and no-fault systems answer the fundamental question of auto accident compensation in opposite ways:

- Fault systems look backward to assign blame and extract payment from the responsible party.

- No-fault systems look inward to the injured person's own insurance coverage, bypassing the question of fault entirely for most claims.

Traditional tort liability systems operate under common law negligence principles requiring third-party liability determinations through judicial proceedings. These frameworks maintain fundamental requirements that fault be established through preponderance of evidence standards before compensation becomes available.

Tort systems preserve all elements of negligence doctrine: duty of care, breach of that duty, factual and proximate causation, and actual damages.

Statutory no-fault/PIP regimes represent comprehensive legislative departures from common law tort, creating first-party benefits systems with specific statutory authority. No-fault systems typically mandate four categories of first-party coverage:

- Reasonable and necessary medical, surgical, and rehabilitative services.

- Percentage of gross income replacement, typically 60-85% with maximum duration limits.

- Replacement costs for household services that the injured person cannot perform.

- Survivor benefits and funeral expense coverage.

What Are The Key Differences Between Fault and No-Fault Systems?

These theoretical distinctions translate into concrete operational differences that shape case strategy from intake through resolution:

Fault vs No-Fault Auto Insurance By State (2025)

The following table maps each state's insurance regime, PIP requirements, and threshold standards:

*Representative overview of all U.S. jurisdictions. Practitioners should verify current requirements with state insurance departments, as laws evolve frequently.

**Regime Type Definitions:

- Add-On = PIP benefits available, but full tort rights retained.

- Choice = Drivers may elect limited or full tort coverage.

- No-Fault = Mandatory PIP with restrictions on lawsuits unless injury threshold met.

Recent Auto Insurance Law Changes: 2025 State Updates

Several states have enacted significant reforms to liability limits and coverage requirements:

- Utah Liability Minimum Increases: Utah increased liability minimums in 2025 to $30,000/$65,000 bodily injury and $25,000 property damage. The PIP minimum of $3,000 and the $3,000 medical threshold for lawsuit access remain unchanged.

- Hawaii Coverage Enhancement: Hawaii's PIP minimum remains $10,000, with lawsuits allowed when medical costs exceed $5,000 or for permanent injury/disfigurement. Liability limits increase effective January 2026 to $40,000/$80,000/$20,000.

- New Jersey Coverage Enhancement: New Jersey courts established that PIP medical coverage includes $250,000 per person per accident, with mandatory bodily injury liability scheduled to increase to $35,000/$70,000 on January 1, 2026.

- Pennsylvania Surcharge Threshold: Pennsylvania adjusted the insurer surcharge threshold to $2,250 in 2025. This change affects when insurers may increase premiums but does not alter the limited-tort threshold for lawsuit access, which remains based on serious injury (death, serious impairment, or disfigurement).

Legislative Reform Trends and Judicial Developments

Beyond statutory changes, courts continue to shape how auto insurance law operates in practice. Recent judicial interpretations have narrowed threshold access, strengthened causation requirements, and restricted benefit calculations:

- Michigan's PIP Choice System: Michigan has enacted substantial no-fault reform since 2020, creating a system allowing consumer choice in PIP coverage levels. Public Acts 21 and 22 of 2019, effective July 1, 2020, introduced six PIP medical coverage options ranging from $50,000 to unlimited coverage. Drivers may select lower PIP limits but cannot waive PIP entirely (except Medicare enrollees).

- Enhanced Threshold Requirements: New York courts established procedural restrictions in American Trust Insurance Co. v Comfort Choice Chiropractic, P.C., holding that separate arbitral awards cannot be combined to meet the $5,000 threshold for de novo review under Insurance Law § 5106(c).

- Strengthened Causation Standards: The New Jersey Appellate Division in Charlotte Zavis v. NJM Insurance Company held that summary judgment is appropriate when plaintiffs cannot prove causation without comparative analysis, distinguishing pre-existing spinal injuries from accident-related injuries.

- Restrictive Benefit Interpretation: Florida applied narrow statutory construction in Allstate Insurance Company v. Revival Chiropractic, LLC, holding that insurers may pay 80% of submitted charges when less than the statutory maximum, rather than 80% of reasonable and necessary expenses.

Key Jurisdictional Variables in Auto Insurance Law

The state-by-state variation in auto insurance regimes creates practical challenges for multi-jurisdictional practice. Understanding these differences is essential for accurate case evaluation, strategic planning, and client counseling. Four key variables drive most of the operational distinctions practitioners encounter.

- PIP Coverage Requirements and Limits

PIP mandates and coverage limits vary significantly across no-fault and add-on benefit states. Minimum requirements range from $3,000 to $50,000, with varying benefit categories including medical expenses, wage replacement, and essential services coverage. These variations directly affect the coordination of benefits analysis and subrogation considerations.

- Threshold Standards for Tort Access

Threshold standards determine when injured parties can pursue tort claims in no-fault states. Jurisdictions employ verbal thresholds based on injury severity, monetary thresholds based on medical expenses, or dual systems allowing either standard. Understanding these threshold requirements is essential for case evaluation and strategic development.

- Subrogation and Coordination Requirements

Subrogation limitations and coordination requirements affect recovery strategies, particularly regarding Medicare/Medicaid reimbursement obligations, health insurance coordination, and workers' compensation interactions. These requirements vary substantially between fault and no-fault jurisdictions.

- Liability Standards and Procedural Requirements

Insurance regime classification affects liability standards and procedural requirements from initial case evaluation through trial preparation. Each system creates distinct evidentiary burdens, documentation requirements, and litigation timelines that shape case strategy.

Navigating Fault vs No-Fault Auto Insurance Systems

The distinction between fault and no-fault systems shapes every phase of personal injury practice, from case evaluation to settlement and trial. Understanding which regime governs a case determines what evidence matters, when litigation can proceed, and how compensation flows. With ongoing reforms in Utah, Hawaii, Pennsylvania, and other jurisdictions, staying current with threshold changes and coverage modifications is essential.

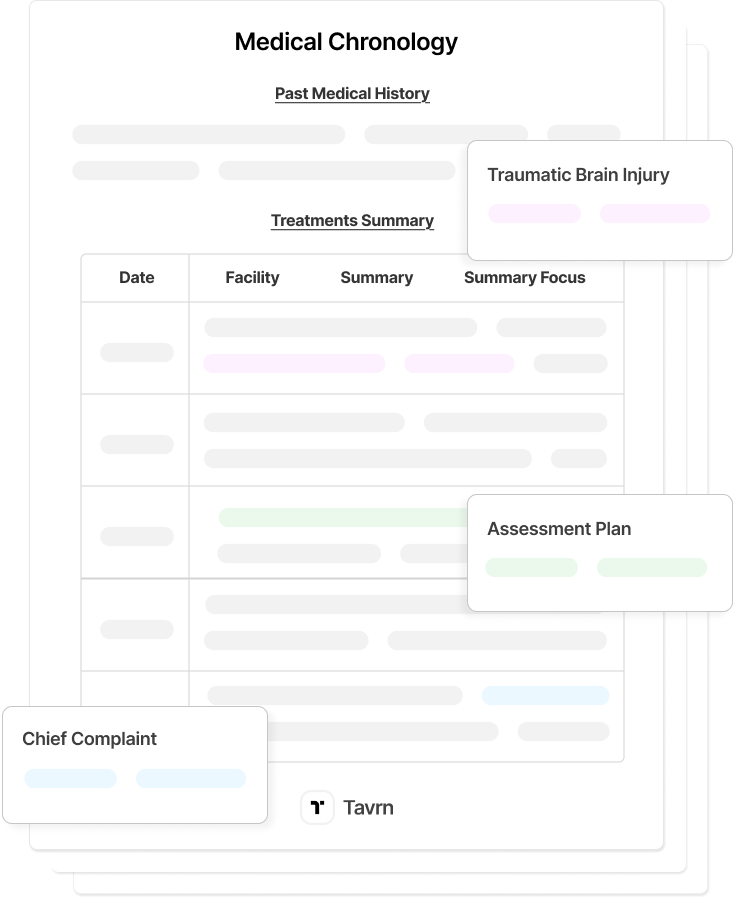

Modern legal practice increasingly relies on AI-powered solutions to manage multi-jurisdictional complexities efficiently. Tavrn's platform automates medical record retrieval, generates structured chronologies in under 24 hours, and streamlines demand letter drafting, reducing record review time by up to 70%. This allows firms to focus on strategic legal analysis while maintaining accuracy across both fault and no-fault jurisdictions.

Ready to streamline your personal injury practice? Book a demo.

.webp)

.webp)